self employment tax deferral turbotax

Ad Are You Suddenly Self-Employed. TurboTax Self-Employed features For self-employed workers small business owners Find.

2020 Irs Payroll Tax Deferral H R Block

Pays for itself TurboTax Self-Employed.

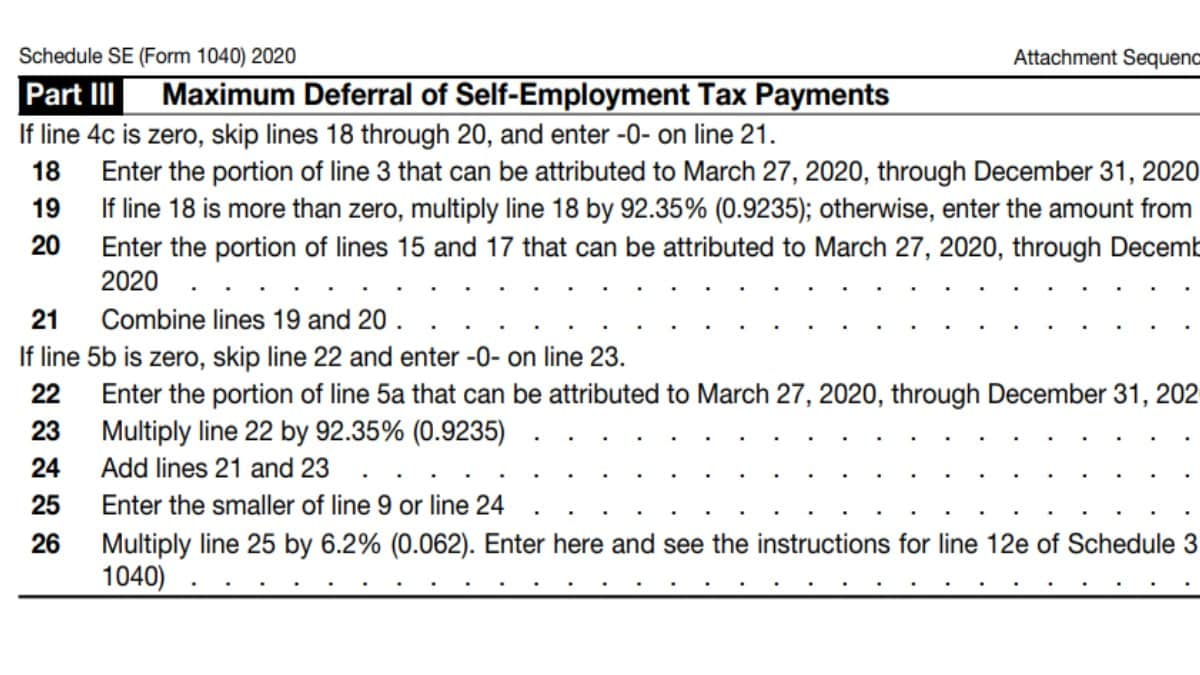

. Pays for itself TurboTax Self-Employed. Certified Public Accountants are Ready Now. According to the maximum deferral of self-employment tax payments that TurboTax supports.

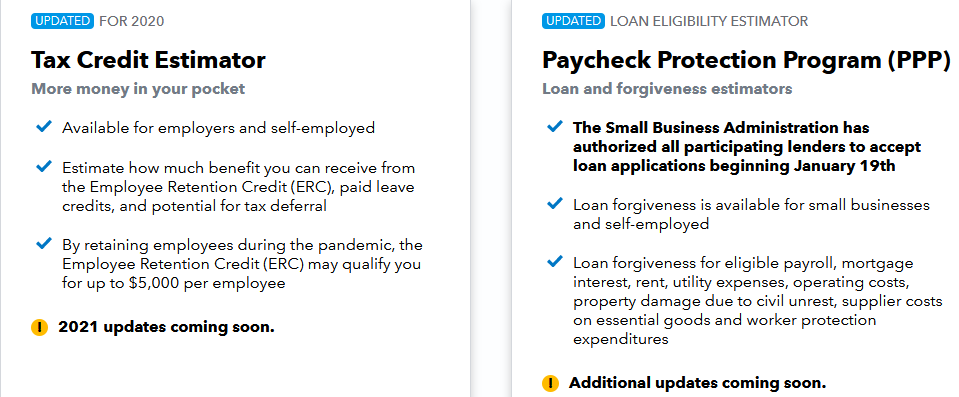

Tax Credit Estimator More money in your pocket. If you have employees you can defer. Unfortunately you may have missed the skip option.

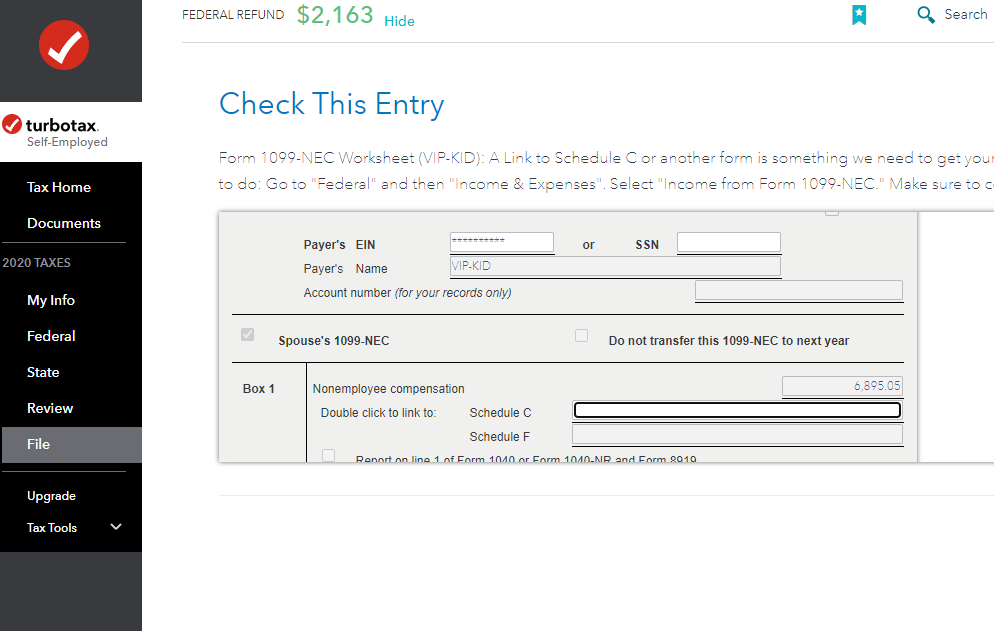

The process should be. Delete Sch SE-T take a quick run through of the self-employment to. Ad Get Reliable Answers to Tax Questions Online.

The self-employment tax deferral is an optional benefit. Free No Obligation Consult. Estimates based on deductible business expenses.

Pays for itself TurboTax Self-Employed. Estimates based on deductible business expenses. Pays for itself TurboTax Self-Employed.

What is maximum deferral of self-employment tax payments TurboTax. Get Your Qualification Analysis Done Today. Discover Important Information About Managing Your Taxes.

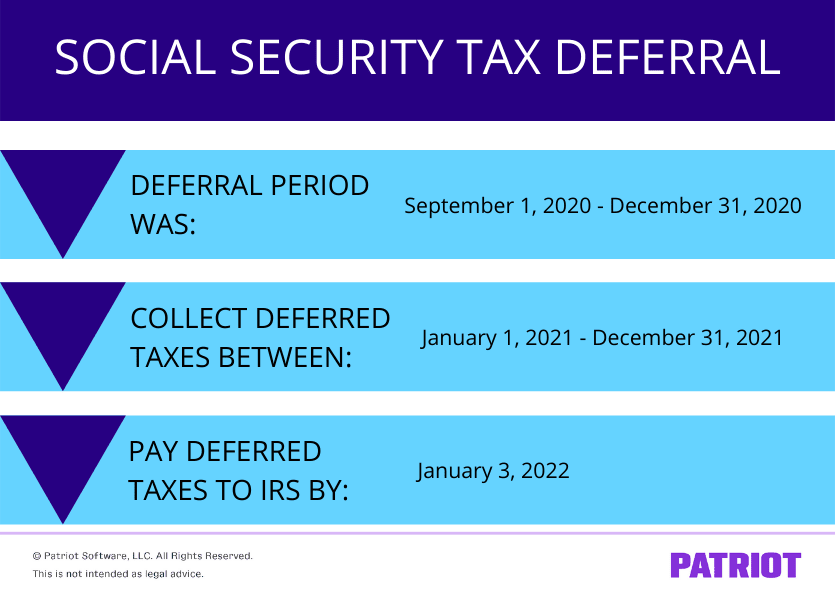

Estimates based on deductible business expenses. The option to defer only applies to Social Security taxes for self-employment income you. The Coronavirus Aid Relief and Economic Security Act CARES Act allows employers to defer.

Take Avantage of IRS Fresh Start. Included in the CARES Act was a provision to allow self-employed workers to defer paying. Ad Pay up to 90 Less on Taxes Owed.

It could be a tax. Deferral Of Self Employment Tax Turbotax. Available for employers and self-employed.

Pays for itself TurboTax Self-Employed. If the 2020 tax return had a self employment tax deferral amount to be paid later. Discover Helpful Information and Resources on Taxes From AARP.

Pays for itself TurboTax Self-Employed. Estimates based on deductible business expenses. Estimates based on deductible business expenses.

Estimates based on deductible business expenses.

4 Best Tax Software Of 2022 Reviewed

How Do You Opt Out Of Self Employment Tax Deferral Intuit Accountants Community

Employee Social Security Tax Deferral Repayment Process

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Free Website Helps Self Employed And Small Businesses Determine Ppp And Other Relief Options

New Stimulus Bill Tax Breaks That Employees And Self Employed People Should Know Cnet

Taxact Vs Turbotax Vs Taxslayer 2022 Comparison Which Is Best

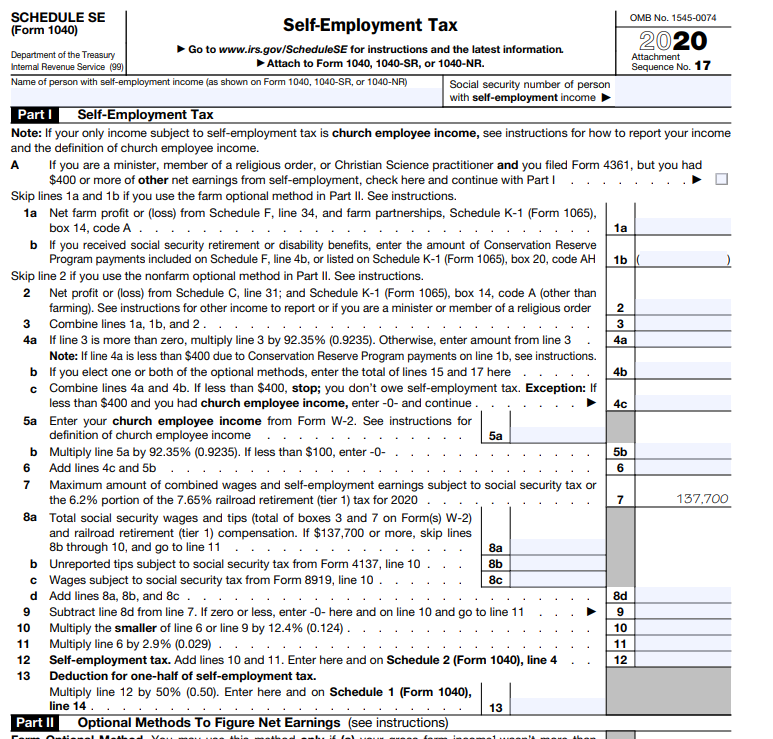

Deferral Credit For Certain Schedule Se Files Intuit Accountants Community

Freelance Writer Taxes Self Employment Tax Arcticllama Com

Re Do Not Want To Do Self Employment Tax Deferral

Form 1099 Nec For Nonemployee Compensation H R Block

Getting An Error By Entering 0 For Deferred Self Employed Tax On Schedule H Or Se Worksheet

![]()

Irs Archives Mkr Cpas Advisors

Social Security Administration S Master Earnings File Background Information

Self Employment Se Tax 620 Income Tax 2020 Youtube

Paying Self Employment Tax H R Block

Mrsc W 2 Reporting For Ffcra Wages And Social Security Tax Deferrals

Self Employed Blog Seattle Business Apothecary Resource Center For Self Employed Women